Delivering Ready Mix Concrete Monday – Saturday

The global cement industry is a critical component of infrastructure development, with production and ownership structures reflecting economic, political, and environmental dynamics. This note provides a comprehensive analysis of who produces and owns cement worldwide, based on recent data and industry trends as of May 31, 2025. It expands on the key points and includes detailed insights into major producers, country-level production, and ownership structures.

Global Cement Production Landscape

Cement production is heavily concentrated in certain countries, with China leading by a significant margin. In 2023, China produced over 2.1 billion metric tons, accounting for approximately 50% of global output.

India follows with 410 million metric tons, and Vietnam with 110 million metric tons, highlighting Asia’s dominance in the sector. This concentration is driven by rapid urbanization and infrastructure projects, particularly in China, where cement is a cornerstone of construction, unlike regions like the United States, where wood is more common for housing.

The industry faces challenges, including environmental concerns, with large-scale production contributing to pollution, especially in China, where state support has boosted over-production.

Sustainability efforts, such as reducing CO2 emissions, are increasingly important, with companies like HeidelbergCement and Holcim investing in alternative fuels and low-carbon technologies.

Major Cement Producers and Their Capacities

The largest cement companies by production capacity, based on 2024 and 2025 data, are as follows:

| Rank | Company Name | Production Capacity (Million Metric Tons/Year) | Headquarters |

|---|---|---|---|

| 1 | China National Building Material Co. Ltd. (CNBM) | 530 | China |

| 2 | Anhui Conch Cement Company Limited | 288 | China |

| 3 | Holcim | 274 | Switzerland |

| 4 | HeidelbergCement | 121 | Germany |

| 5 | Cemex | 87 | Mexico |

This table is derived from recent industry reports, such as Statista – Capacity of biggest global cement producers 2024 and Construction Kenya – Top 10 Largest Cement Producers. Note that there was a discrepancy in earlier data, with some sources listing CNBM’s capacity lower (e.g., 176.22 million metric tons), but the most recent Statista data (March 2025) confirms 530 million, suggesting updates in capacity or reporting methods.

Other notable producers include China Resources Cement Holdings (71 million metric tons, state-owned), Taiwan Cement Corporation (64 million metric tons, publicly traded), Eurocement (45 million metric tons, likely private with possible state ties in Russia), and Votorantim Cimentos (45 million metric tons, privately held by the Brazilian Votorantim Group).

Ownership Structures and State Influence

Ownership is a critical aspect, with significant variation across companies:

- State-Owned Enterprises (SOEs):

- CNBM is fully state-owned by the Chinese government, reflecting China’s strategy to control key industries

.

- China Resources Cement Holdings is part of China Resources, another state-owned enterprise, emphasizing state dominance in China’s cement sector.

- Anhui Conch, while publicly listed on the Hong Kong and Shanghai Stock Exchanges, has its largest shareholder, Anhui Conch Holdings, owned by the Anhui Provincial People’s Government via subsidiaries like Anhui Provincial Investment Group Holdings Co., Ltd. and China Conch Venture Holdings

. This structure indicates significant state influence, with the government controlling major stakes.

- CNBM is fully state-owned by the Chinese government, reflecting China’s strategy to control key industries

- Publicly Traded Companies:

- Holcim, headquartered in Switzerland, is publicly traded on the SIX Swiss Exchange, formed by the merger of Lafarge and Holcim in 2015

. It operates in over 90 countries, focusing on sustainability and innovation.

- HeidelbergCement, based in Germany, is listed on the Frankfurt Stock Exchange, with operations in over 50 countries, emphasizing sustainable practices like reducing CO2 emissions

.

- Cemex, headquartered in Mexico, is listed on both the Mexican Stock Exchange and the New York Stock Exchange, serving the Americas and beyond

.

- Taiwan Cement Corporation, based in Taiwan, is publicly traded, reflecting the region’s industrial focus

.

- Holcim, headquartered in Switzerland, is publicly traded on the SIX Swiss Exchange, formed by the merger of Lafarge and Holcim in 2015

- Private Companies:

- Votorantim Cimentos, the largest in Brazil, is privately held by the Votorantim Group, a conglomerate with diverse interests

.

- Eurocement, Russia’s largest, is likely private, though large Russian companies often have indirect state ties, though specific ownership details were not fully clarified in the data

.

- Votorantim Cimentos, the largest in Brazil, is privately held by the Votorantim Group, a conglomerate with diverse interests

Mergers, Acquisitions, and Industry Dynamics

The cement industry has seen significant consolidation, affecting ownership and market share. For instance, Holcim was formed by the merger of Lafarge and Holcim in July 2015, creating one of the largest global players.

Similarly, Italcementi (Italy) became part of HeidelbergCement in 2016, expanding its global footprint.

Technological advancements, such as AI in supply chain optimization, are enhancing operational efficiency, with companies like Anhui Conch collaborating with Huawei on AI models for cement production.

These innovations are crucial for meeting growing demand, driven by infrastructure projects and government initiatives, particularly in Asia

Economic and Environmental Implications

Cement production is closely tied to economic growth, with demand often reflecting real estate and infrastructure activity.

However, the environmental impact is significant, with China’s cement industry criticized for pollution despite economic benefits.

Companies are responding with sustainability goals, such as Anhui Conch’s target to reduce emissions intensity by 6% by 2025 compared to 2020, aligning with China’s carbon peak and neutrality goals

Conclusion

In summary, no single entity produces or owns all the cement in the world; instead, the industry is dominated by a mix of state-owned enterprises (especially in China), publicly traded companies, and private firms. Chinese companies like CNBM (state-owned, 530 million metric tons/year) and Anhui Conch (state-influenced, 288 million metric tons/year) lead in capacity, followed by international players like Holcim (publicly traded, 274 million metric tons/year) and HeidelbergCement (publicly traded, 121 million metric tons/year). Ownership structures reflect national policies, with China’s state control contrasting with the public and private models in other regions. This diversity underscores the global and multifaceted nature of the cement industry as of May 31, 2025.

Key Citations

- Construction Kenya Top 10 Largest Cement Producers

- Statista Capacity of biggest global cement producers 2024

- World Population Review Cement Production by Country 2025

- Wikipedia Anhui Conch Cement

- Forbes Anhui Conch Cement Company Overview

- WorldAtlas Top Cement Producing Countries

- Building Radar Top 15 Largest Cement Companies

- Yahoo Finance 20 Largest Cement Producing Countries

- Global Cement Anhui Conch

- World Benchmarking Alliance Heavy Industries Benchmark

Global Cement Market Overview 2025

This post explores the world cement market, highlighting production by country, key producers’ capacities, and ownership details. Data is based on 2023-2024 figures and 2025 projections from sources like Statista, World Population Review, and IMARC Group.

Cement Production by Country (Million Metric Tons, 2023 & 2025 Est.)

Key Producers, Capacity, and Ownership

| Company | Headquarters | Production Capacity (Million Metric Tons/Year, 2024) | Ownership |

|---|---|---|---|

| China National Building Material (CNBM) | China | 530 | State-owned |

| Anhui Conch Cement | China | 288 | Publicly listed, state-influenced |

| Holcim | Switzerland | 274 | Publicly traded |

| HeidelbergCement | Germany | 121 | Publicly traded |

| Cemex | Mexico | 87 | Publicly traded |

Market Insights:

- Total Production (2023): 4.1 billion metric tons, estimated to remain stable or grow slightly by 2025 due to demand in Asia, Africa, and infrastructure projects.

- Market Value: Valued at USD 407.4 billion in 2024, projected to reach USD 673.8 billion by 2033 (CAGR 5.16%).

- Trends: Shift toward sustainable cement (e.g., blended cement with fly ash, slag), driven by environmental regulations and urbanization.

- Key Drivers: Population growth, infrastructure investments (e.g., India’s Smart Cities Mission), and eco-friendly production innovations.

-

LDCC Low Density Cellular Concrete

Low-Density Cellular Concrete (LDCC) from Volume Concrete LLC offers several advantages over traditional backfill materials like gravel or dirt for foundation backfilling, depending on the specific project needs. LDCC is a lightweight, flowable material made from a mixture of cement, water, and preformed foam, which creates air cells that reduce its density while maintaining sufficient…

-

Riprap Grout on the Interstate

On a crisp March morning in 2025, the stretch of Interstate 5 just south of Portland, Oregon, buzzed with purpose. The Oregon Department of Transportation had a problem: drivers kept veering off the highway, carving rogue paths into the soft embankments. The solution? A line of locally sourced riprap boulders—gorgeous, rugged giants pulled from the…

-

Concrete Calculator Challenge

Concrete Calculator Challenge Level: Beginner | Progress: 0/5 Enter your answer (in cubic yards): Submit Reset Game Score: 0

-

Indus Valley Civilization

Looks like you want some answers? Here are the answers to the questions about the Indus Valley Civilization:

-

URM UnReinforced Masonry Building

Unreinforced masonry buildings (URM buildings) are structures made from bricks, stones, concrete blocks, or other masonry units that are not reinforced with steel bars (rebar) or other forms of internal support. These buildings rely solely on the weight of the masonry units and the mortar that binds them together for structural integrity. Key characteristics of…

-

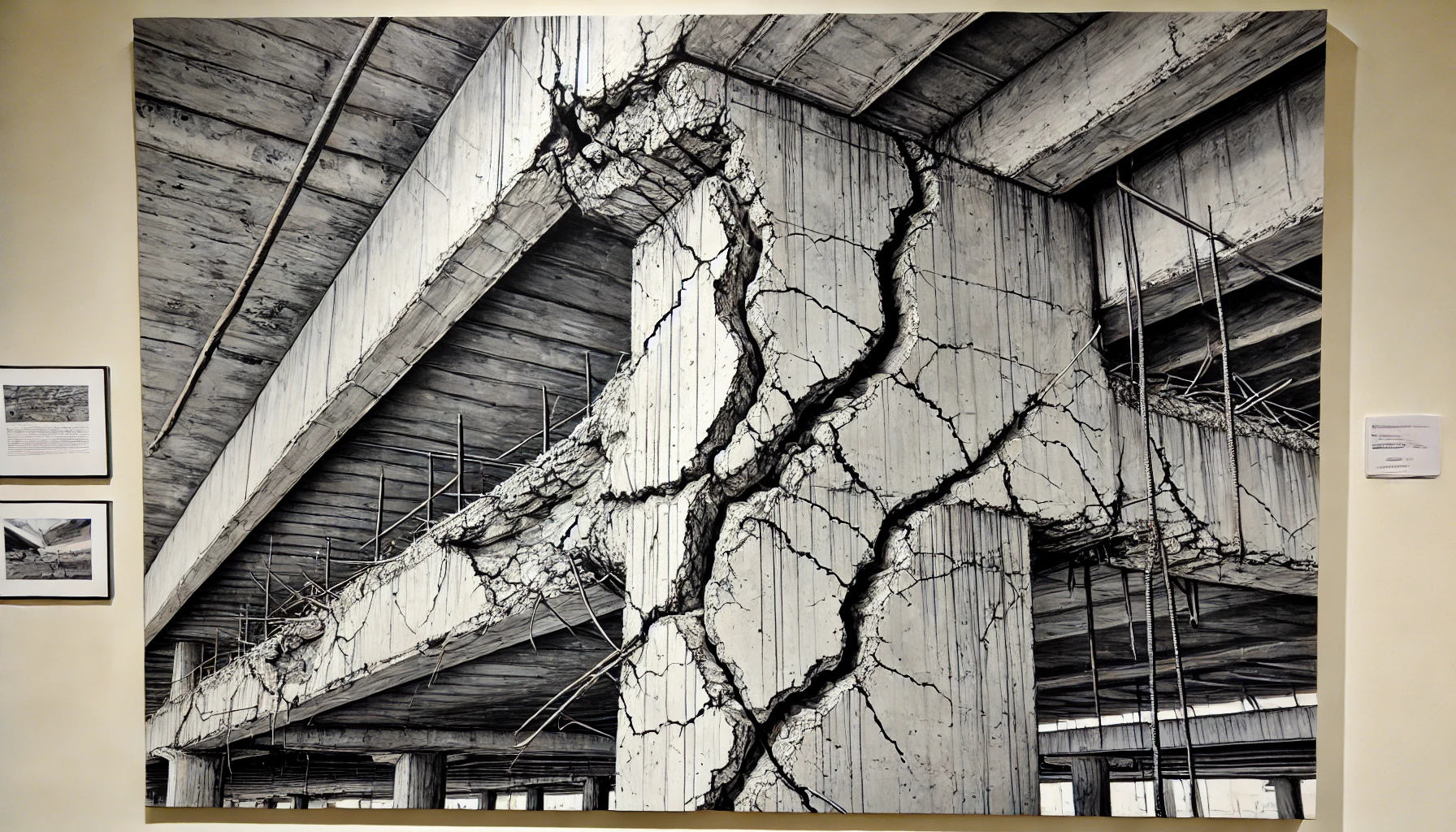

Tofu Dreg Construction

Tofu Dreg construction is a term used to describe shoddy and substandard building practices. Originating from Chinese slang, it likens the poor quality of these constructions to the fragility of tofu, which is easily breakable and lacks structural integrity. Key characteristics of Tofu Dreg construction include the use of low-grade or inappropriate materials that do…

-

Structural and non-structural cracks in concrete – know the difference

Structural and non-structural cracks in concrete differ primarily in their causes, implications, and the urgency of their repair. Structural Cracks: Non-Structural Cracks: Summary Table: FeatureStructural CracksNon-Structural CracksCausesExternal loads, seismic activity, design flawsThermal changes, plastic and drying shrinkage, minor settlementImplicationsCompromise structural integrity, potential collapseAffect appearance, can lead to durability issuesExamplesFlexural cracks, shear cracks, foundation settlement cracksCrazing,…

-

Cracks in Concrete

Cracks in concrete are a common issue influenced by various factors. According to Layang (2022), cracks are unavoidable but can be controlled in size. They are categorized into non-structural and structural types, caused by factors ranging from material properties to external loads. Abou-Zeid et al. (2007) explain that cracks can signify both minor and major…

-

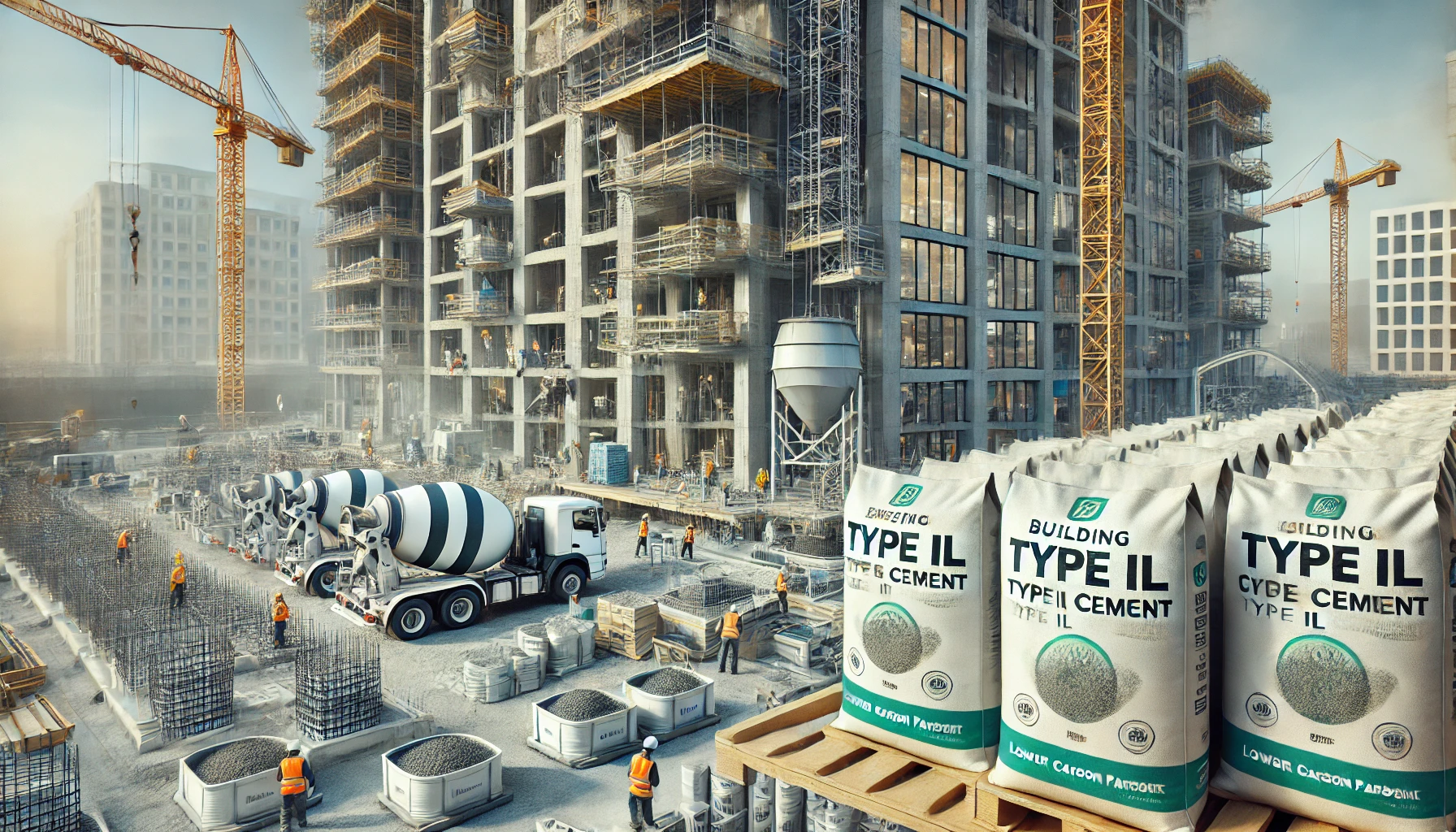

Type IL cement exhibits improved resistance to chemical attacks compared to traditional Portland cement

Type IL cement exhibits improved resistance to chemical attacks compared to traditional Portland cement (Type I), primarily due to its composition and the incorporation of additional materials that enhance its durability in aggressive environments. The increased limestone content in Type IL cement contributes to a denser microstructure, reducing permeability and enhancing resistance to chemical ingress.…

-

How does the carbon footprint of Type IL cement compare to traditional Portland cement?

Type IL cement, also known as Portland-Limestone Cement (PLC), has a lower carbon footprint compared to traditional Portland cement (Type I) due to several factors. The primary advantage of Type IL cement is its increased limestone content, which means that less clinker, the most carbon-intensive component of cement, is needed in its production. Studies have…